- Recovery in the residential property sector continues, albeit at a slower pace amid rising

borrowing costs and growing inflationary pressure. - Office leasing activity edges up following normalisation of business operations.

- Retail industry rebounds strongly with higher footfall supporting retail sales growth, although

the growth momentum is dampened by concerns of rising living costs and a weaker

economic outlook. - Malaysia’s position as an ideal investment destination continues to be positive for the

industrial property sub-sector. - The reopening of China’s borders and resumption of more international flights will accelerate

recovery of the hospitality sector.

Malaysia’s economy continues its strong growth momentum, underpinned by strong pick-up in domestic demand, improving labour market conditions as well as favourable policy support. Knight Frank Malaysia, the independent global property consultancy, has released its Real Estate Highlights 2 nd half of 2022 (“REH”) which features insights into the performance of the property markets across Klang Valley, Penang, Johor Bahru and Kota Kinabalu.

Keith Ooi, Group Managing Director, Knight Frank Malaysia said, “In 2022, most of the world came out of intermittent lockdowns, and we entered a year of rising interest rates, geopolitical uncertainty, supply chain disruptions, and record inflation rates. The performance of the property market sector is in tandem with robust economic recovery, as Bank Negara Malaysia expects full-year growth to exceed its forecast of 7%.”

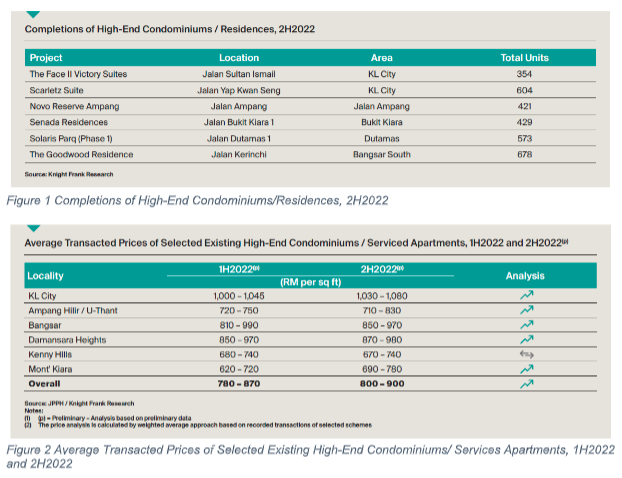

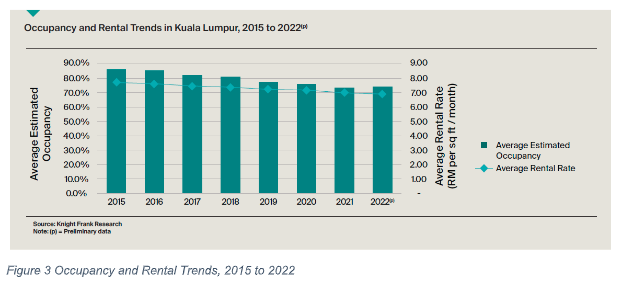

RESIDENTIAL SECTOR

During the review period, Bank Negara Malaysia increased the Overnight Policy Rate (OPR) thrice by 25 basis points each, in response to rising inflationary pressures. This has a direct impact on borrowing costs and is expected to affect purchasing decisions by homebuyers.

According to Judy Ong, Senior Executive Director of Research and Consultancy, Knight Frank Malaysia, “The pricing of high-end condominiums in the secondary market trended positively due to the normalisation of economic activities, coupled with reopening of the country’s international borders and the return of expatriates.” The overall rental market is expected to remain positive, with new completions featuring upgraded features attracting higher rents than older schemes. She adds that there has been an increased awareness of environmental issues among discerning purchasers who now seek quality and sustainable features in their homes, with financial institutions also beginning to introduce green financing facilities.

OFFICE SECTOR

In the second half of 2022, the Kuala Lumpur office market remained competitive with Judy Ong attributing this to a widening supply-demand disparity brought on by recent and incoming completions in both KL City and KL Fringe, coupled with MNCs embracing hybrid work models. Selangor office market remains resilient with increasing leasing activities, particularly for Grade A buildings in prominent locations. Looking ahead, the Klang Valley office market remains tenant-driven, with landlords focusing on retaining tenants through cost-optimization, asset enhancement initiatives, and leasing incentives.

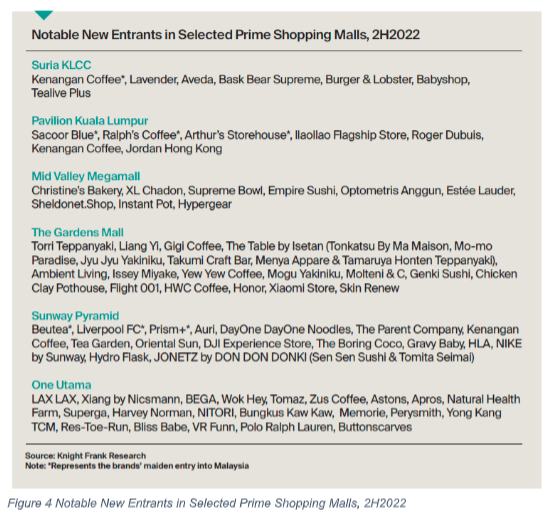

RETAIL SECTOR

Amidst economic recovery, the retail industry rebounded strongly with full year retail sales growth revised to 41.6%, following the impressive 96.0% growth in 3Q2022. Local and foreign brands continue to debut in prime shopping centres while existing retailers strategize for expansions. Amy Wong, Executive Director of Research and Consultancy, Knight Frank Malaysia said that with shifting shopping patterns and evolving e-commerce landscape in this age of digitalisation, retailers and mall operators are increasingly leveraging on flagship and specialty stores to increase sales and improve engagement. She also mentioned that mall operators are currently adopting sustainability

and ESG (environmental, social, and governance) initiatives in efforts to adapt to the rapidly changing market.

The MIER Consumer Sentiments Index (CSI), recorded at 98.4 points in 3Q2022, however, signifies cautious consumer sentiment moving into 2023. Nonetheless, the local retail sector is expected to remain favourable supported by steady domestic demand and with the country’s newly formed government pledging to prioritise the issue of rising cost of living.

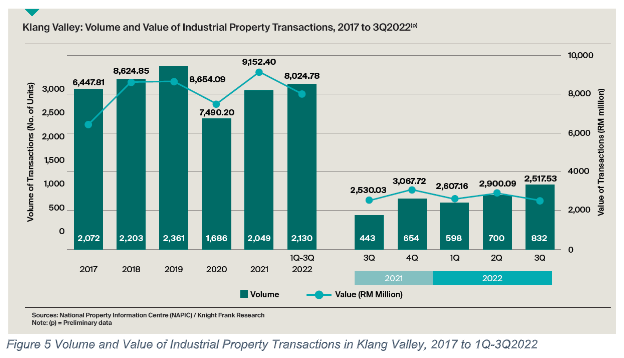

INDUSTRIAL SECTOR

The industrial property sector remains on an upward growth trajectory with a steady pipeline of distribution and warehouse projects, driven by strong and steady demand from both logistics players and investors. Klang Valley remains one of the ideal destinations in Malaysia for nearshoring of firms with focus on South-East Asia as it offers the right balance between cost, efficiency and quality.

According to Amy Wong, “The industrial property sector in Klang Valley saw a rebound in market activity with 2,049 industrial properties worth RM9.15 billion changing hands in 2021, reflecting annual increments of 21.5% and 22.2% in transacted volume and value respectively. The analysed average price per industrial transaction was marginally higher by 0.5%.”

Multiple economic initiatives have been unveiled to drive the industrial sector with the aim to spur post pandemic growth in 2022. These include attracting Foreign Direct Investments (FDI) and Multi-National Companies (MNCs) as well as empowering SMEs to drive economic growth. In the short to medium term, the improving market trajectory is expected to continue into 2023, supported by strong enablers such as better logistics infrastructure, increasing freight volumes, structural growth in e-commerce and supportive government policy.

SABAH PROPERTY MARKET

Alexel Chen, Executive Director, Knight Frank Sabah says that Sabah recorded higher number of new residential launches, improved occupancies of selected privately owned purpose-built office buildings, and encouraging footfalls as well as entry of new brands in notable shopping malls. There is also renewed interest in Sabah’s hospitality market with improving number of tourist arrivals supported by resumption of direct flights into Kota Kinabalu International Airport from international cities like Taipei, Narita, Busan and Hong Kong.

Considering that the Asia-Pacific economy will face significant headwinds in 2023, Malaysia will continue its recovery albeit at a slower pace, amid the shadows of an overcast global economy.

Rounding off the outlook for 2023, Keith Ooi concluded that to drive the property sector forward, the key initiative should be on introducing green incentives. “We hope the government will introduce ‘green incentives’ to property buyers, landlords, occupiers and developers who are aligned with the nation’s target of becoming a ‘net zero’ nation by 2050,” he said as the growing awareness and adoption of ESG frameworks in the property market will help drive the value of sustainable real estate moving forward.

.jpeg)

.jpg)

.jpeg)