There has been plenty of talks recently in relation to the Goods and Services Tax (GST) and the Sales and Service Tax (SST) and what the impact of each is to the consumers. There is also plenty of information that has been made available to the public through various sources including the social media, in some instances adding to the confusion on how these taxes operate.

The purpose of this article is not to lend support to either tax, but to help the public understand how these taxes work and how they apply to the purchase of goods and services so that the public can be better informed about the issue.

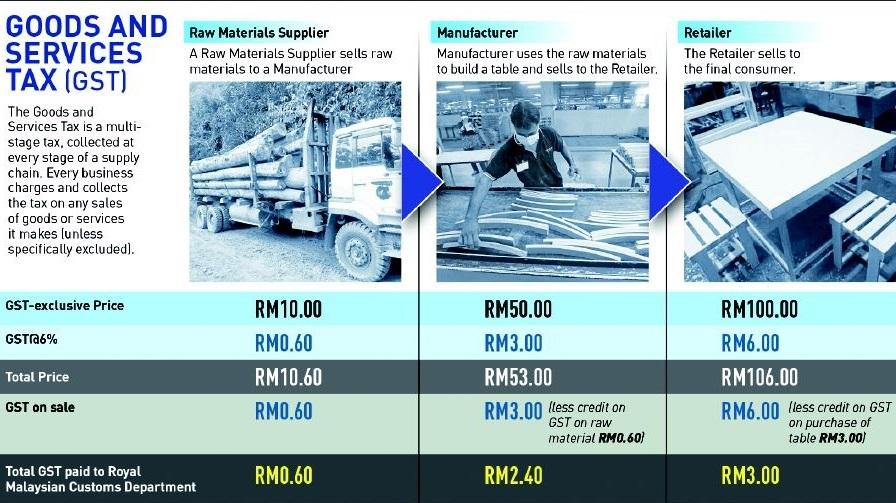

Goods and Services Tax The GST is a multi-stage tax, meaning it is collected at every stage of a supply chain. In simple terms, every business is effectively required to charge and collect the tax on any sales of goods or services they make (unless specifically excluded). However, a major misunderstanding about GST is that it is seen as several layers of tax on tax.

This is not the case as the business is allowed to claim a credit on any GST paid on the purchase of goods and services.

In the case of New Straits Time's GST illustration, a total of RM6 is collected by the Royal Malaysian Customs Department (RMCD) through the distribution chain. RM0.60 from the raw materials supplier, RM2.40 from the manufacturer and finally RM3.00 from the retailer. Importantly, this RM6.00 is equal to what the final consumer actually pays on the purchase of the table, i.e., RM6.00.

So the key points to note are:

GST is a tax on the final consumption or sale of goods and services

GST is collected at every stage of the supply chain

GST is a credit system that allows businesses to offset GST paid on purchases so that there is no ‘double tax'

One final point is that although GST did apply to most goods and services, there were a lot of exemptions and zero-rated items including basic foods, medicines, public transport, taxis etc. So in some cases, there was no GST paid by the consumer in the purchase.

Sales and Service Tax The first thing to clear up is that there is no such thing as Sales and Service Tax. It is Sales Tax and Service Tax, which are two separate taxes. These are not new taxes, and had, in fact, existed in Malaysia since the 1970s and were only removed in 2015 when the GST was introduced.

Sales Tax Sales Tax is a single stage tax applied on importers and manufacturers of certain prescribed goods. It has rates of 5.0 per cent and 10 per cent and is collected by manufacturers or importers.

There is no credit mechanism for tax paid.

It needs to be noted that the illustration is a very simple example to highlight how the tax works. Businesses these days have complex supply chains and pricing decisions are impacted by a number of factors, of which tax is only one.

Service Tax Service Tax is also a single stage tax and applies at a rate of 6.0 per cent on services that are in-scope. It also does not have a credit mechanism for any tax paid.

Am I paying tax twice under SST? There has been plenty written about whether consumers will be hit with a 16 per cent tax. This is not correct and is not how these taxes would work. In saying that it is possible that a consumer may purchase an item that has been subjected to sales tax and service tax, the scope of these taxes are narrow and there is not that much crossover. Where that crossover does happen, the total cost should still not be 16 per cent.

So the key points to note about SST are:

Two separate taxes - Sales Tax and Service Tax

Not a new tax to Malaysia and was in existence for a long period of time

Only collected at one stage of the supply chain and apply to a narrower set of goods and services

It is possible for Sales Tax and Service Tax to apply on the same item but only in limited circumstances and it would be wrong to say it is a 16 per cent tax.

As the Sales Tax and Service Tax are single stage taxes only taxing one stage of the supply chain, it keeps more businesses out of the tax net. This can be a good and bad thing. It means that fewer businesses are impacted and need to incur costs to comply, but it also means that it creates opportunities for more businesses to avoid collecting the tax.

These are inherent issues in the tax that will hopefully be addressed when it is reintroduced.

.jpeg)

.jpg)

.jpg)

.jpeg)