PropertyGuru today released its biannual Consumer Sentiment Study for H2 2021, which found that 73% of Malaysians are looking to change their home situation after spending more time indoors due to COVID-19. Of those surveyed, 38% want to renovate or repurpose certain areas of their home, while 35% are starting to think more about owning a home or moving out of their current location.

Source: Property Hunter Instagram

The pandemic has impacted Malaysians’ perception of space at home, as more than 3 in 4 people (77%) now consider it important for new properties to have an additional room at home that can be used as a home office. The increasing desire to own a home or move into a property that can meet their needs is especially high among renters (74%), individuals who live with their parents (63%), and those in the low-income group (50%).

Sheldon Fernandez, Country Manager, PropertyGuru Malaysia said, “Malaysia has undergone various forms of lockdowns in the last 17 months, and this extended time at home has made more people realize the importance and benefits of having a space of their own, especially in the age of remote working. The pandemic’s effect on the way in which people plan their home life is more prominent among young Malaysians, low-income earners, and those currently living with their parents, who cited ‘needing more personal space’ as one of the top reasons of wanting to purchase a new home.”

Among all Malaysians surveyed, regardless of demographic and current living situation, the need for more personal space (26%) is ranked as the third reason for wanting to purchase a property, while the top two reasons are investment (43%) and to take advantage of the low interest rates available now (27%).

Property Market Presents Both Opportunities and Hardships

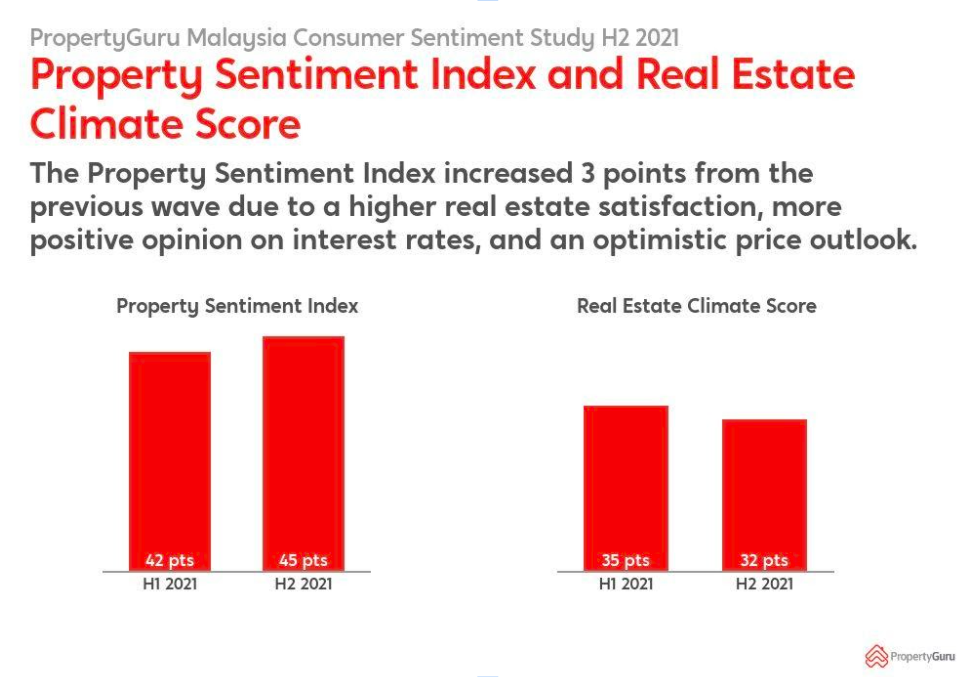

The favourable interest rates and price outlook, as well as the high current real estate satisfaction have increased the study’s overall Sentiment Index by 3 points from 42 in H1 2021 to 45 in H2 2021. On the other hand, Malaysians’ sentiment on the current real estate climate has declined by 3 points from 35 in H1 2021 to 32 in H2 2021.

Those who are satisfied with the current real estate climate in Malaysia mentioned that good long-term prospects for capital appreciation as the top reason for them feeling this way. Meanwhile, those who are dissatisfied cited inability to find a property within their budget as their top reason.

“From the findings of our study, it is clear that the COVID-19 pandemic has created both opportunities and hardships for many Malaysians who are looking to purchase a home. Nonetheless, the desire to own a home remains strong among Malaysians as more than 4 in 5 intend to buy a property in Malaysia in the future,” said Sheldon.

While many Malaysians would like to own a home, 67% have chosen to defer their property buying decision to 1-5 years due to COVID-19 as they continue to face challenges in their homeownership journey during this time.

The study found that compared to H1 2021, more Malaysians are now uncertain about property prices (56%; up from 52%), experiencing delays in property transactions (51%; up from 42%), and facing difficulties in securing home loans (46%; up from 43%) in H2 2021 due to the pandemic. Malaysian home seekers also cited inability to afford down payment and unstable job or salary as their top two barriers to taking a home loan in H2 2021.

A Desire for More Measures from Government and Property Players

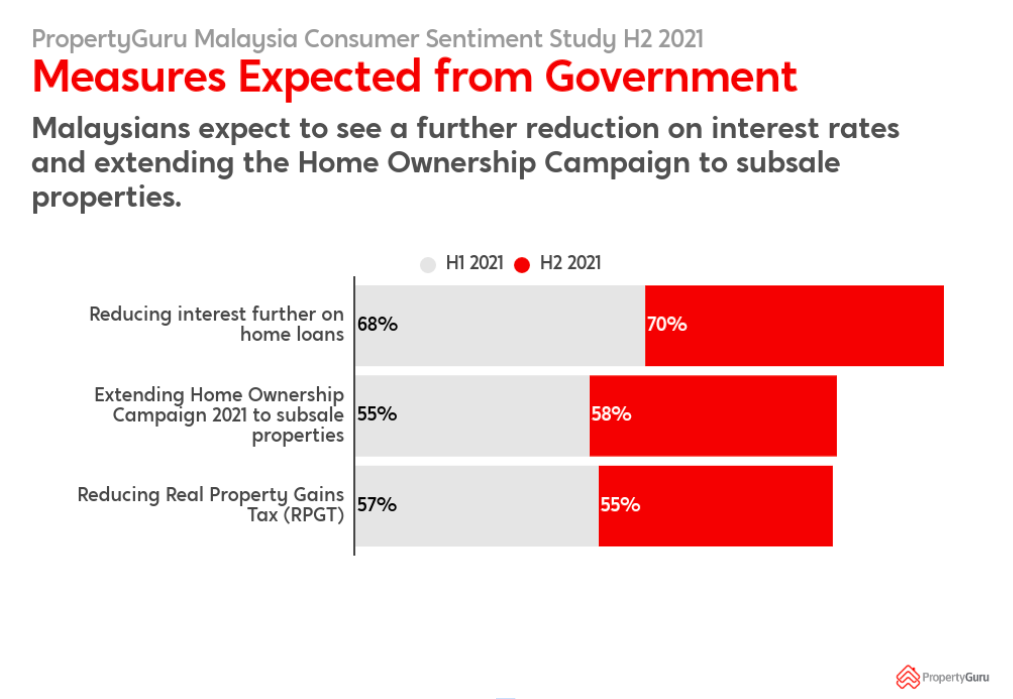

Despite the various property relief measures introduced by the government such as the extension of the Home Ownership Campaign (HOC) to end 2021, only 16% of Malaysians perceive governmental efforts to make housing affordable as sufficient. The majority believe that the government can do more to help the property sector, with the top three measures they expect from the government being further reduction of interest on home loans (70%), extension of the HOC to subsale properties (58%), and reduction of Real Property Gains Tax (55%).

Meanwhile, Malaysians also believe financial incentives from property developers such as discounts or cashback (84%), purchasing packages and schemes (66%), and vouchers or gifts (38%) can help encourage future home purchase decisions.

Sheldon shared, “While the current economy and the property market is challenging, we at PropertyGuru, will remain committed to help Malaysians navigate through their homeownership journey with confidence by providing them with the right information and solutions to find the right property. We hope that the insights gathered from the study can also help property players and the government better understand the current consumer sentiment so that informed decisions can be made to help spur the property market and address home seekers’ needs.”

.jpeg)

.jpg)

.jpg)

.jpeg)