The Overnight Policy Rate (OPR) is an overnight interest rate set by Bank Negara Malaysia (BNM). It is a rate a borrower bank has to pay to a leading bank for the funds borrowed. The OPR, in turn, has an effect on employment, economic growth and inflation. It is an indicator of the health of a country’s overall economy and banking system.

7 May 2019: Bank Negara cuts OPR rate to 3%

The move to cut the rate to 3% is a response towards what looks like a weak economic outlook, with moderate economic activity in the first quarter of 2019. The lower rate is also to ease difficult financial situations.

Previous OPR change: Increase by Bank Negara Malaysia on 25 Jan 2018

On 25 January 2018, Bank Negara Malaysia increased the Overnight Policy Rate (OPR) by 25 points to 3.25%. This is the first OPR hike to happen since July 10, 2014. As a quick recap, BNM has maintained the OPR at 3% since July 2016 which was the last time any changes were made to the OPR. Previously, BNM maintained the OPR at 3% during its last Monetary Policy Committee (MPC) meeting on 9 November 2017.

In July of 2016, BNM announced the reduction of OPR, which was a first reduction to happen in 7 years. The OPR reduction happened in light of the risks that were rising from Britain’s withdrawal from the European Union (EU) that was also known as Brexit.

What Does An OPR Increase (or Decrease) Mean For Malaysians?

A rise in OPR would mean that banks will increase the base lending rate (BLR) and base financing rate (BFR) because a rise would directly influence both. BLR is the rate that is determined by conventional banks based on the cost of lending to consumers. While BFR is a rate determined by Islamic banks based on the cost of lending to consumers. Therefore the rise of OPR will result in a higher interest rate or profit rate for loans that are tagged to BLR or BFR.

For example: Assuming that a loan has a BLR at 6.60%. A 0.25% hike in OPR will then increase BLR from 6.60% to 6.85%.

As a result of this, taking on a loan after the OPR increase will cost more for Malaysian consumers because of the increase in the loan interest rate. So buying a car will then cost more, and servicing an existing housing loan may also cost more as the interest rate has gone up.

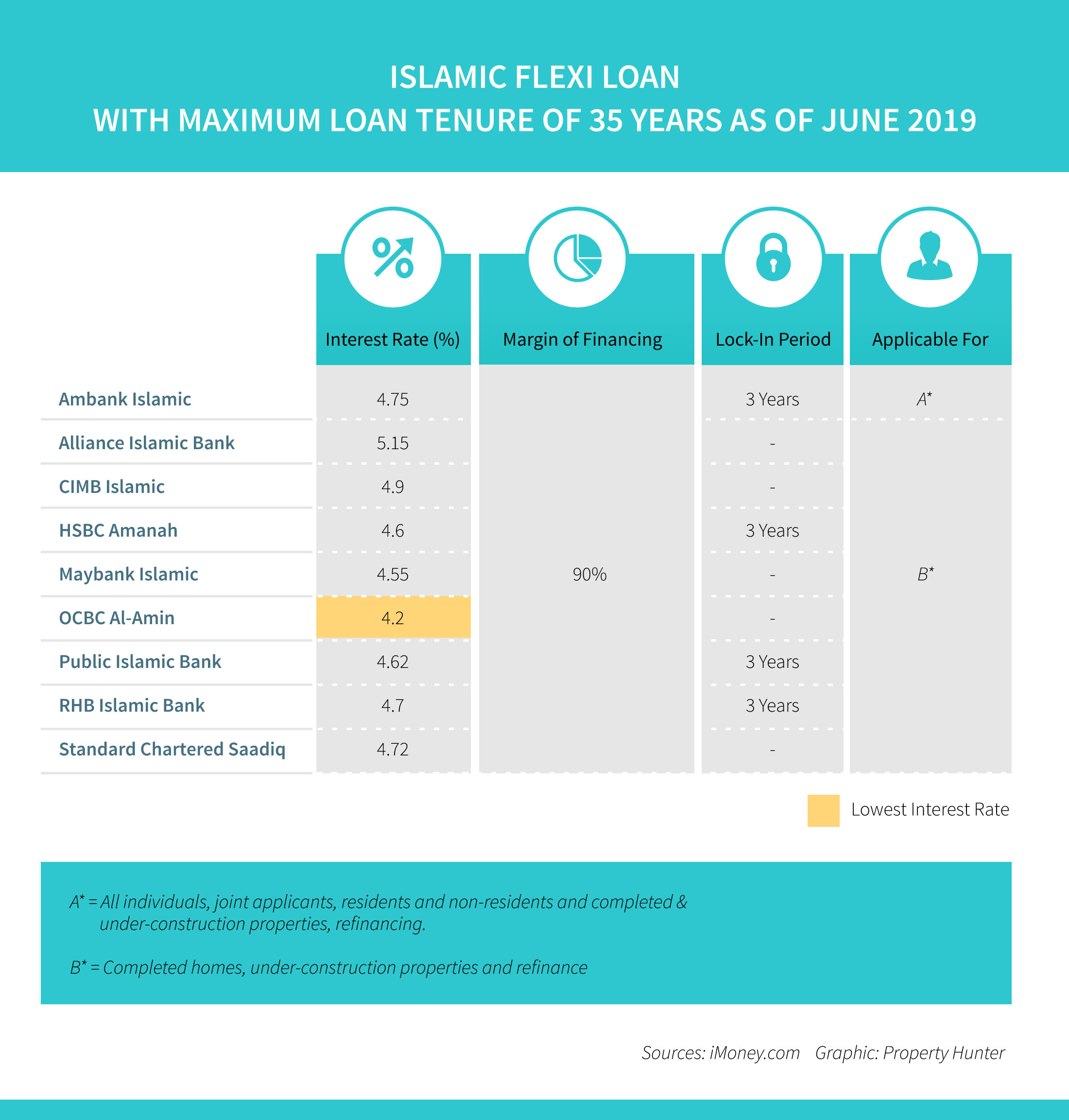

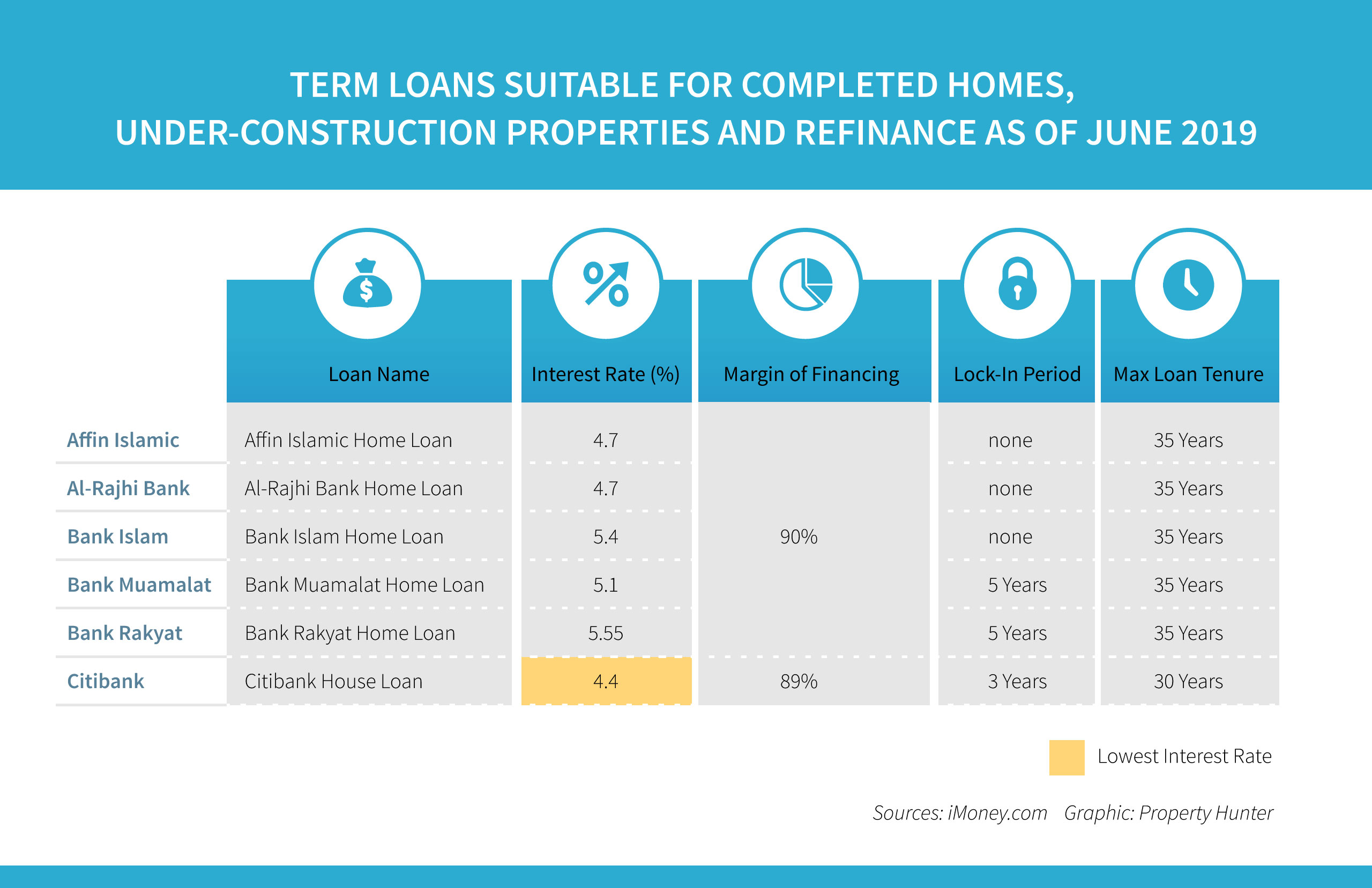

With that said, below tables are the loan interest rate for some banks after the OPR cut this year. All data are taken as of June 2019.

_PH_Banner_(Desktop)(1200x180px).png)

.jpeg)

.jpg)

.png)

.jpeg)