Iskandar Malaysia, the southern economic corridor, has since its inception in 2006 till the first half of 2019 (1H2019), recorded cumulative committed investment of RM302.09 billion (Source: Iskandar Regional Development Authority, IRDA). With its current performance pace, Iskandar Malaysia is expected to exceed the targeted investment sum of RM383 billion by 2025.

A total of RM172.2 billion or 57% of the total investment has been realised as of 1H2019 with 39% being foreign direct investment mainly from China (RM40.65 billion) and Singapore (RM20.57 billion).

The Chinese have been investing heavily into property developments while the Singaporeans continued to eye on the manufacturing / logistics sector.

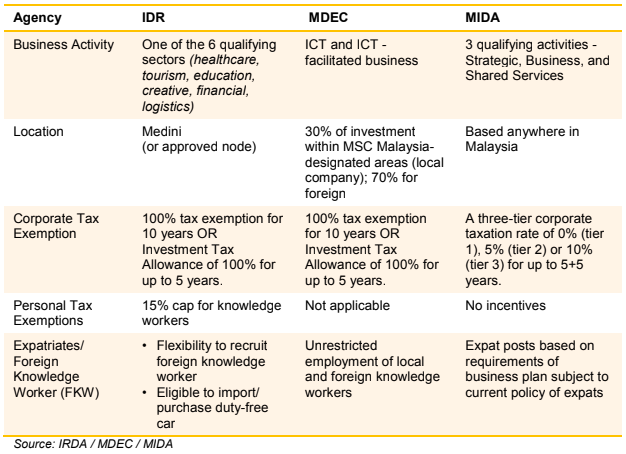

Sarkunan Subramaniam, Managing Director of Knight Frank Malaysia, says, “Various organisations namely Iskandar Regional Development Authority (IRDA), Malaysia Digital Economy Corporation (MDEC) and Malaysian Investment Development Authority (MIDA) have initiated incentives to encourage investment from both local and foreign investors in the region.”

Summary of Notable Incentives available for Investors in Iskandar Malaysia:

Sarkunan adds, “Foreign investors have shared that they were most concerned with possibilities of lower operation cost, strategic location and talent pool / skilled labour in making their decisions to invest in the region. The availabilities of such factors are attractive to foreign investors as the impact of lowering operating expenses in the flow of the supply chain on a long-term basis is essential for businesses to remain competitive.

Top Considerations Attracting Foreign Investors

1) Lower operation cost

2) Strategic location

3) Talent pool / skilled worker

4) Infrastructure

5) Incentives and Policies

6) Strong Demand

Source: Knight Frank (Johor), Independent Investors Sentiment Survey (2019)

“The manufacturing / logistics sector has been rosy with more market activities being observed during the first half of 2019. Now investors are also eyeing the healthcare sector, a specialised asset class deemed defensive within its niche market.”

Tay Kah Poh, Head of Consultancy of Knight Frank Singapore, says, “Singaporean investors are certainly positive towards the healthcare sector in Iskandar Malaysia with the advantages being its proximity to the country, favourable exchange rate, and quality healthcare that is comparable to that of Singapore. Major healthcare players such as Thomson Medical and Gleneagles have built and operate quality healthcare facilities in Johor and the clustering will act as a huge draw for patients from Singapore.”

Debbie Choy, Branch Head of Knight Frank Johor, says, “The macro statistics for Iskandar Malaysia remain strong and encourage positive sentiments for the market. Whilst there are certain sectors which may be experiencing oversupply, such as the high-rise residential segment, we observe that the healthcare and industrial sectors are glowing despite the challenging property market environment. Opportunities in these two sectors continue to appeal to investors.

“One of the key elements that would further drive the success of attracting inbound investment into Iskandar Malaysia is perhaps ensuring sufficient talent pool to support the respective industries. An overflow effect from the increased working population leading to higher demand for housing may benefit Iskandar Malaysia in the longer term.”

.jpeg)

_PH_Banner_(Desktop)(1200x180px).png)

.jpeg)